In the realm of financial oversight, the fight against money laundering is a key priority, with evolving legislative frameworks designed to counter this persistent issue. Leading the charge in the UK are the Money Laundering Regulations 2017 and the Proceeds of Crime Act 2002, both regularly updated to enhance their effectiveness. For legal professionals, understanding these regulations is essential, as adherence not only fulfils legal obligations but also protects against financial crime and upholds the profession’s integrity.

Examining Anti-Money Laundering Legislation

The cornerstone of the UK's AML framework lies in the Money Laundering Regulations 2017 and the Proceeds of Crime Act 2002. These legislative tools establish rigorous standards for detecting, preventing, and addressing money laundering activities. Law firms must adhere to these regulations, which mandate detailed client due diligence and the reporting of suspicious activities to the relevant authorities.

Implications for Law Firms

Compliance with AML legislation is crucial for law firms, extending beyond mere legal adherence to encompass the maintenance of ethical standards and the protection of reputational integrity. AML compliance is integral at every stage of client interaction, from initial onboarding to the final closure of client files, necessitating a comprehensive understanding of AML obligations and a proactive stance on risk management and due diligence.

Client Interaction – From Onboarding to File Closure

Each phase of client engagement presents distinct compliance challenges. During onboarding, law firms must perform thorough due diligence, verifying client identities and assessing money laundering risks. Throughout the engagement, continuous monitoring and risk assessment are essential to detect and address suspicious activities. At file closure, firms must ensure proper record retention in line with regulatory requirements.

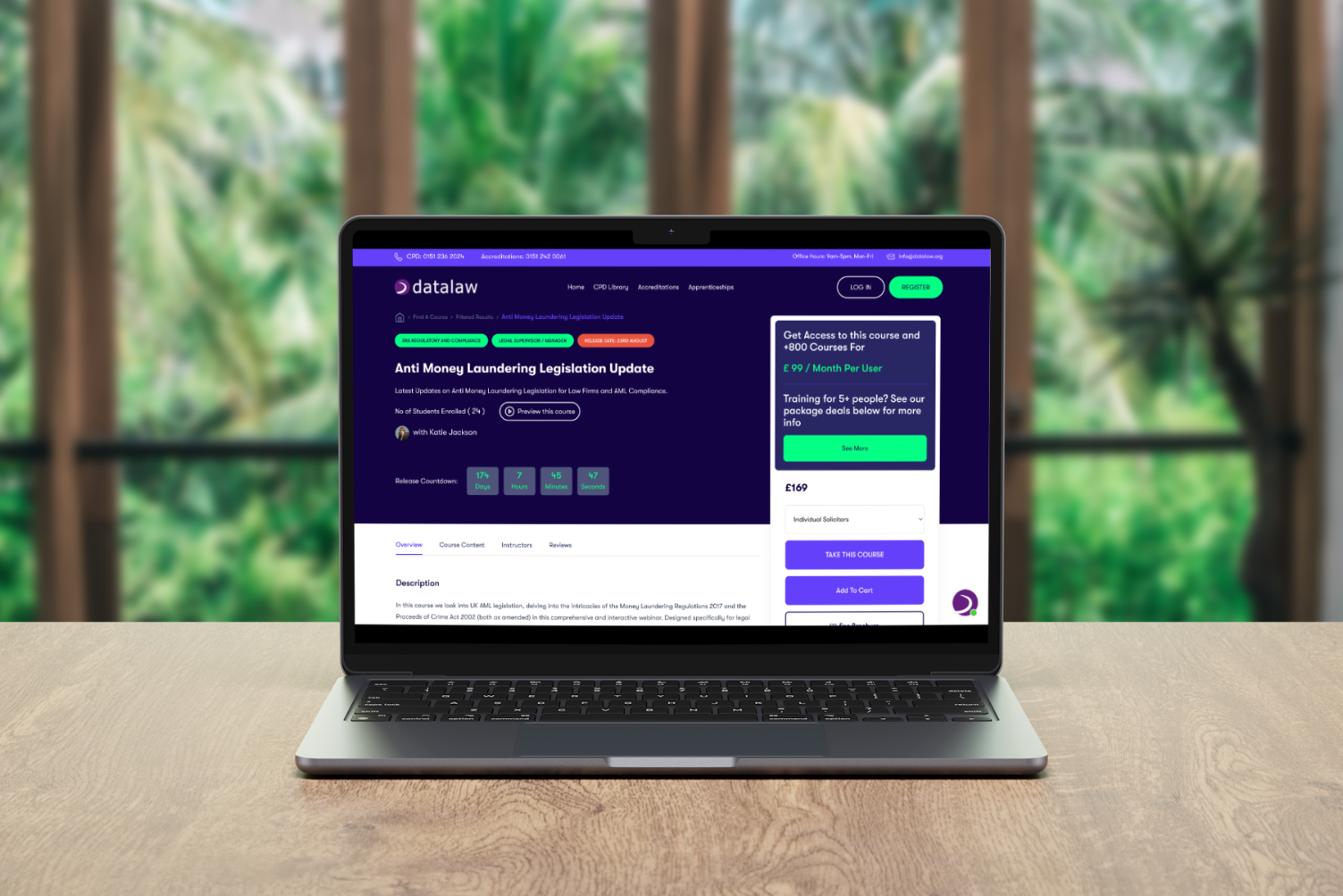

Datalaw’s Anti-Money Laundering Legislation Update Course

Enhance your knowledge of AML legislation with Datalaw’s Anti-Money Laundering Legislation Update course. This course is tailored for legal professionals aiming to master the complexities of the Money Laundering Regulations 2017 and the Proceeds of Crime Act 2002. It provides essential insights into the practical application of AML requirements throughout client engagement, from onboarding to file closure. Enrol now to improve your AML compliance skills and ensure your practice meets regulatory standards.

Conclusion

Effectively navigating AML legislation demands a deep understanding of regulatory requirements and a proactive approach to compliance. Legal professionals who are well-versed in the Money Laundering Regulations 2017 and the Proceeds of Crime Act 2002 can better meet their obligations to prevent money laundering and maintain the profession’s integrity. With AML compliance critical at all stages of client engagement, law firms must stay vigilant and proactive to mitigate risks and uphold regulatory standards.